AI systems for SME business valuation

“Can Your Business Operate for 30 Days with Minimal Owner Involvement and

no Revenue Shock?"

Eliminate one of the biggest valuation discounts in SME exits: Owner dependency.

Buyers discount founder-dependent companies by as much as 50%.

Systematize lead capture, qualification, follow-up, and reporting so buyer-facing processes don’t depend on the founder.

That reduces execution risk, and supports stronger multiples.

MOST SME BUSINESSES

(Founder-Dependent): Owner-dependent businesses often trade at discounted multiples.

Revenue stops when founder unavailable

Critical decisions require founder approval

Sales process lives in founder's head

YOUR BUSINESS

(Using AI Systems): Owner-independent, documented, predictable businesses can justify higher multiples — depending on sector, size, growth, and buyer type.

AI handles lead capture 24/7 (no founder)

Automated qualification & follow-up

Sales pipeline runs on documented processes

Buyers see "operationally mature, scalable systems"

In many SMEs, systemising sales + operations can reduce buyer 'discounts' within 6–18 months.

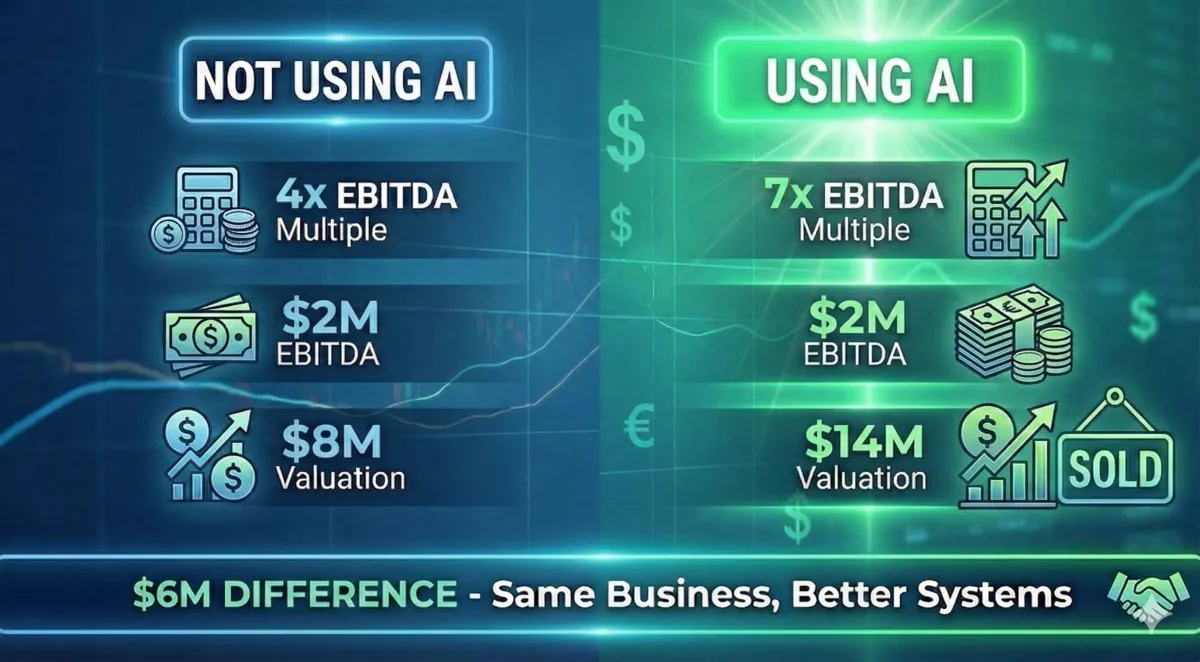

The valuation impact depends on EBITDA, predictability, and dependency risk.

We'll Identify your Biggest Valuation Levers:

Most calls uncover $2M-$8M in hidden value opportunities.

AI CASE STUDIES: The Difference AI Can Make for Businesses

Industry Examples:

E-commerce client increased cart size 15% and customer retention 12% in 45 days - $180K annual revenue lift.

Property management company implemented ViewingBot - now handles 100% of viewing requests 24/7 without founder involvement.

Distribution company implemented AI forecasting - 15% inventory improvement led to multiple increase from 7x to 9x EBITDA.

Buyer-ready performance metrics

AI Systems that move the KPIs - Buyers actually pay for

Each system is tied to measurable before/after KPIs and documented for due diligence.

Recurring Revenue %

Buyers pay 3-5x higher multiples for recurring revenue vs one-off sales. We help you identify and test 20-40% revenue shift opportunities within 90 days, with full implementation in 6-12 months.

Owner Dependency Score

We score your dependency on a 0-100 scale. Target: Under 30. Result: Buyers see 'scalable systems' not 'key person risk.

Process Reliability

Documented, automated SOPs that ensure 95%+ delivery quality without founder oversight. Buyers call this 'operational maturity.'

Net Margin & Cash Conversion

AI reduces low-value labor by 30-50%, improving margins by 2-4 points. Shorter cash cycles = better working capital metrics buyers demand.

THE BUYER’S LENS

The 4 Metrics Buyers Use to Calculate Your Multiple

We design systems from the buyer lens: predictable cash flows, margin quality, transferability and transparency. On the free ValuAI Audit we translate your numbers into buyer-style KPIs and a 6–18 month plan.

Durability (Recurring Revenue)

Without AI: one-off sales, low retention. With AI: automated upsells and renewal flows; predictable recurring revenue → +1.5–2x multiple impact.

Earnings Quality (Margin Profile)

Without AI: high labor costs. With AI: automation saves time 30–50% → 2–4 point margin uplift → +0.5–1x multiple impact.

Transferability (Owner Independence)

Without AI: founder-owned knowledge. With AI: documented playbooks and SOPs; business operates 30+ days without founder — +2–3x multiple impact.

Transparency (Financial Visibility)

Without AI: delayed reports and Excel chaos. With AI: dashboards and automated reporting — buyers pay premiums for visibility (+0.5–1x).

implement High-value AI systems

Operational AI that ensures

the business works even without you.

Focus on systems that remove you from the critical path, standardize delivery, and give buyers confidence they’re acquiring a machine—not a job.

24/7 Lead Capture System

Never miss a lead—even when you're offline

Centralize inbound leads from web, phone, and email into a single 24/7 AI-assisted intake that qualifies, routes, and books directly into calendars.

What it does:

AI phone receptionist answers calls 24/7

Website chatbot qualifies visitors

SMS/WhatsApp follow-up automation

Results:

40-60% increase in lead capture rates

Zero founder involvement required

Buyers see "always-on revenue engine"

Higher show rates & faster response times.

Consistent lead data for sales reporting.

Staff removed from manual follow-ups.

Founder-Free Sales Process

Systematize your sales so deals close without you

Turn your business-specific knowledge into SOPs that AI agents check and use in real-time—to support your team.

What it does:

Document your proven sales playbook

AI qualification & routing

Automated follow-up sequences

Real-time pipeline visibility

Results:

30-50% reduction in founder sales time

Standardized delivery (reduces rework)

Buyers see "repeatable, scalable process"

Standardized delivery across staff.

Audit trail () buyers can trust.

Executive Dashboard & Forecasting

Real-time visibility buyers demand

Centralize revenue, pipeline, operations, and finance data into an AI-assisted cockpit that surfaces risks before they become surprises.

What it does:

Automated financial reporting

Predictive cash flow models

KPI tracking (recurring revenue, margins, dependency)

Due diligence-ready data room

Results:

Weekly KPI reports in plain English

Forecasts tested to actual leading indicators

Buyers see "institutional-grade transparency"

Weekly KPI and variance reports in plain English.

Forecasts tied to actual leading indicators.

Due diligence-ready reporting in a few clicks.

The process starts with your value engineering map, then we prioritize 2–4 systems that can create measurable uplift for your business within 90 days.

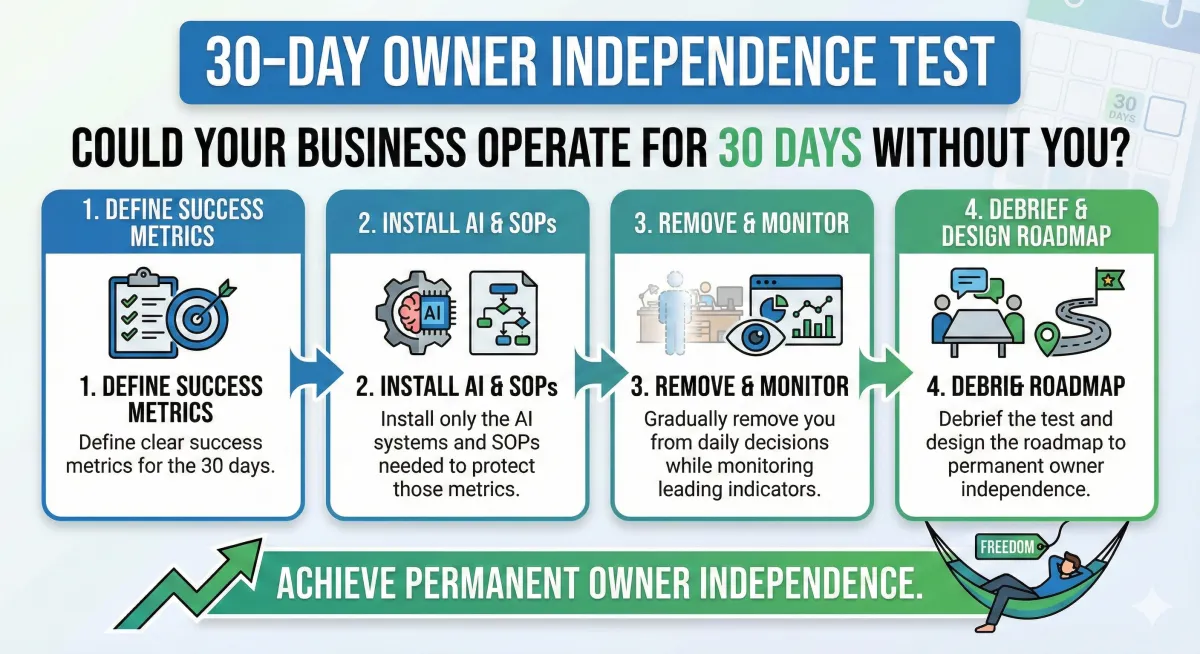

30-day owner independence test

Could Your Business Operate for 30 Days Without You?

We run a structured, low-risk experiment: we design AI and process scaffolding so your business can operate with minimal owner involvement for 30 days, then measure the results.

- Define clear success metrics for the 30 days (revenue, CSAT, backlog, margin).

- Install only the AI systems and SOPs needed to protect those metrics.

- Gradually remove you from daily decisions while monitoring leading indicators.

- Debrief the test and design the roadmap to permanent owner independence.

You keep all systems and documentation from the test—whether or not we keep working together.

What the 30 days look like:

Week 1: Map owner tasks, design guardrails, and implement the first AI systems.

Week 2–3: Run with the new operating rhythm, with daily metrics and exception handling.

Week 4: Stress test, refine, and document—the “Owner Independence Dossier.”

Outcome: a measurable reduction in owner hours and a documented path to a more buyable, owner-optional business.

Recent 30-day test: Property management founder went off-grid for 4 weeks. Business handled 47 viewing requests, closed 3 new leases, zero escalations to founder. Buyer called it 'the most compelling operational maturity proof we've seen.

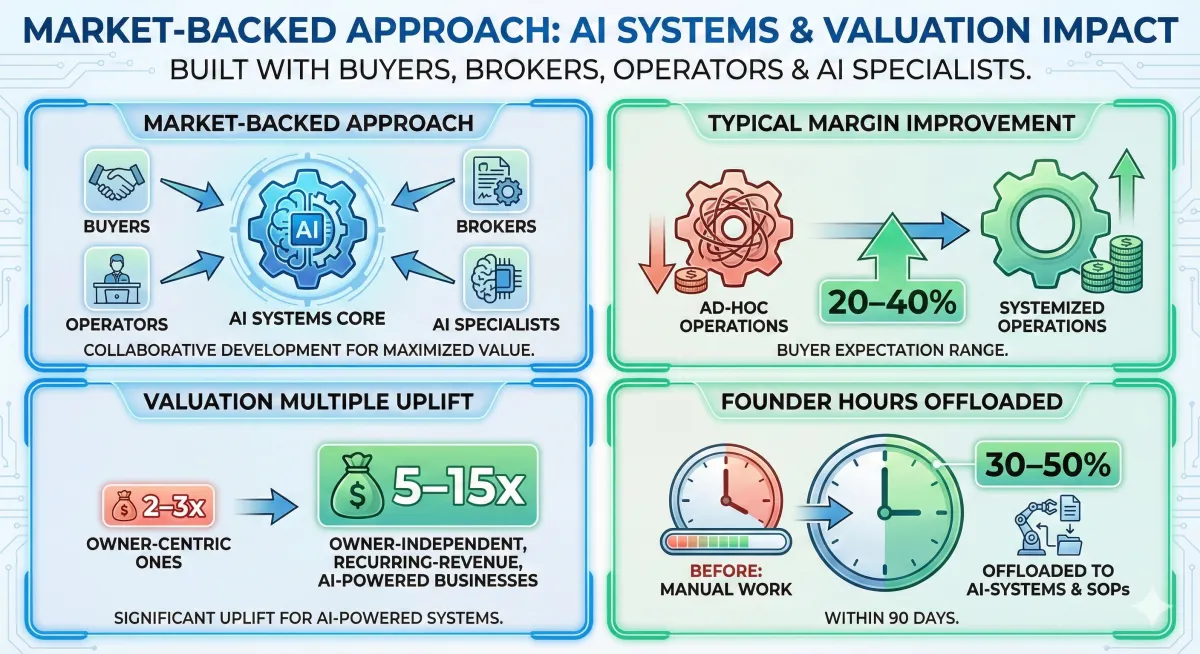

Market-backed approach

Built from Research with Buyers, Brokers, Operators—and AI Specialists.

Our frameworks are based on conversations with buyers of small businesses, M&A advisors, and owner-operators who have been through exits—not theory.

Our job is to turn these market truths into concrete AI and process changes in your business.

What we consistently hear from the market:

Buyers discount businesses where the owner is the “system.” AI can document and harden those systems. ()

Predictable, recurring revenue with low error rates commands better multiples.

Clean data, simple dashboards, and clear AI automated SOPs speed up diligence and reduce re-trade risk.

20-40% Margin Improvement

"Typical margin improvement buyers expect from systematized vs ad-hoc operations (Source: Industry research, 2024)

2-3x Multiple Uplift

"Valuation multiple uplift buyers are willing to pay for owner-independent, recurring-revenue businesses vs owner-centric ones (Source: M&A advisor benchmarks)

30-50% Time Offload

Share of founder hours that can often be offloaded to AI-assisted systems within 90 days (Source: Client implementations 2024-2025)

The 3 AI Systems That Eliminate Founder Dependency

Every System Drives Real, Measurable Value

System 1:

24/7 Lead Capture & Qualification

What you get:

AI phone receptionist (never miss a call)

Website chatbot (qualify while you sleep)

SMS/WhatsApp automation (instant follow-up)

Impact: 40-60% increase in captured leads → Recurring revenue growth

Valuation driver: "Always-on revenue engine" → +0.5-1x multiple

System 2:

Automated Sales & Nurture

What you get:

Document founder's sales process

AI qualification & routing

Automated follow-up sequences

Pipeline visibility dashboards

Impact: 30-50% reduction in founder time → Owner independence

Valuation driver: "Scalable, repeatable process" → +1-2x multiple

System 3:

Real-Time Financial Visibility

What you get:

Automated KPI reporting

Predictive cash flow models

Due diligence-ready data room

Executive dashboards

Impact: Weekly visibility, forecasting accuracy → Earnings quality

Valuation driver: "Institutional transparency" → +0.5-1x multiple

See Which System You Need First

Engagement options

Three Ways to Work Together

Every path starts with the free value uplift call. We’ll recommend the right level—or let you implement the plan yourself.

Clarity (Free)

Value Engineering Consultation

What you get:

45-minute consultation focused on your specific valuation gaps

Buyer-lens KPI review using your current numbers

Custom value engineering map outlining 3-5 AI opportunities

Implementation options you can do with or without us

Best for: Exploring AI and wanting a concrete, valuation-focused plan

Next step: Book Free Consult Below

Rapid Proof (Done-With-You)

30-Day Owner Independence Sprint

What you get:

30-day test design and oversight

Implementation of 2-3 AI systems tied to owner tasks

Weekly operating reviews and KPI tracking

Owner Independence Dossier for future buyers/lenders

Best for: Owners ready to quickly reduce operational load and prove the business can run without them

Next step: Apply for Sprint

Full Transformation (Done-For-You)

AI Operating System Partnership

What you get:

Quarterly value engineering cycles and roadmap updates

Ongoing AI system maintenance, retraining, and expansion

Executive AI cockpit build-out and iteration

Support preparing data rooms and metrics for a future exit

Best for: Owners aiming at a higher-multiple exit in 12-36 months

Next step: Talk to Us

Solutions overview

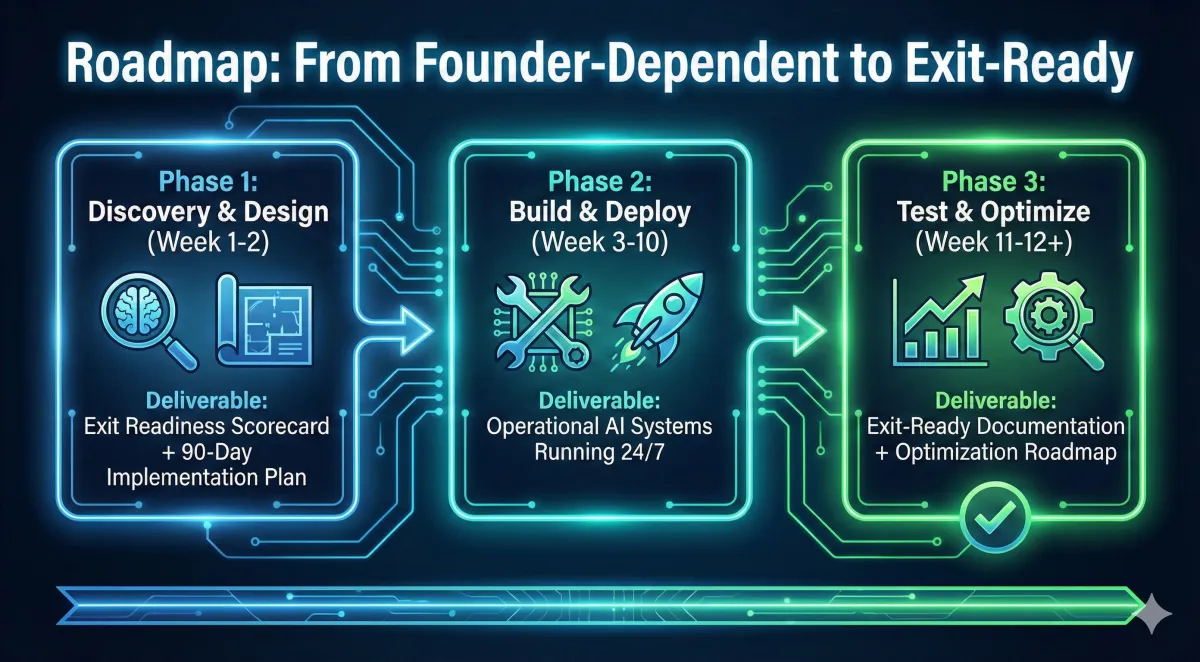

Your Roadmap:

From Founder-Dependent to Exit-Ready

Phase 1: Discovery & Design (Week 1-2)

We sit with you and your leadership team to define the outcomes, KPIs, and systems that will create a more buyable business.

We audit your current operations and identify the 3-5 highest-impact AI opportunities

Score your owner dependency and map it to valuation impact

Design your custom AI roadmap with clear ROI targets

Deliverable: Exit Readiness Scorecard + 90-Day Implementation Plan

Phase 2: Build & Deploy (Week 3-10)

We implement AI agents, automations, and data connections using modern tools that fit your current stack.

Install AI systems for lead capture, qualification, sales nurture, and reporting

Train your team on new workflows (role-specific, not generic)

Document all processes for buyer due diligence

Deliverable: Operational AI Systems Running 24/7

Phase 3: Test & Optimize (Week 11-12+)

We help you embed the new systems into your weekly rhythms, refine over time, and keep them aligned with your valuation goals.

Run 30-day owner independence test

Track KPI improvements (recurring revenue %, margins, dependency score)

Package results for future buyers (before/after metrics)

Deliverable: Exit-Ready Documentation + Optimization Roadmap

Book a Free 15-Minute Exit Valuation Call Below

What happens on this call:

✅ We'll score your founder dependency (0-100 scale) ✅ Identify your #1 valuation bottleneck ✅ Show you the AI system that would eliminate it ✅ Calculate potential multiple improvement (typically €2M-€8M for €2M+ EBITDA businesses)

No sales pitch. If we're not a fit, we'll tell you. If we are, we'll explain next steps.

Duration: 15 minutes Investment: €0

Frequently asked questions

Q: I'm not selling for 2-3 years. Why should I do this now?

A: Two reasons. First, buyers can spot last-minute systematization—they want to see 12-24 months of AI-enhanced performance data. Second, even if you never sell, the operational ROI (30-50% time savings, 2-4 point margin improvement) pays for itself in 6-12 months. You win either way.

Q: What if we don't have clean data or documented processes?

A: That's exactly why AI creates such dramatic value for you. We don't need perfect data—AI works with messy, imperfect inputs. In fact, businesses with manual, founder-dependent processes see the BIGGEST valuation uplifts because the "before/after" contrast is so compelling to buyers.

Q: How is this different from hiring a virtual assistant or operations manager?

A: VAs and ops managers are great for execution, but they don't solve the valuation problem—they just shift founder dependency to employee dependency. Buyers still see "key person risk." AI systems eliminate dependency entirely because they're documented, automated, and buyer-owned. That's what commands premium multiples.

Q: Do you guarantee specific valuation increases?

A: We can't control buyer behavior or market conditions, but we do guarantee the operational improvements (owner dependency reduction, margin expansion, recurring revenue growth). Those improvements are what drive multiples from 4x to 6-7x. If we don't deliver measurable KPI improvements within 90 days, we keep working until we do or refund the difference.

Q: What's the actual investment?

A: Custom engagements typically start from €15K depending on company size and complexity. Usually investments get spread over several months. Most clients see 3-10x ROI within 12 months through time savings, margin improvement, and valuation uplift. We'll discuss specific numbers on your free consultation after understanding your situation.

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

FOLLOW US

SERVICES

COMPANY

CUSTOMER CARE

LEGAL

Copyright 2026. AIHub3. All Rights Reserved.